Guidance for Growth: The Finance Leader’s Role in Business Expansion

It’s a fact: When small and midsize businesses (SMBs) grow, time and money get stretched to the limit. Companies not only hire more people, invest in new equipment and work space, and buy more materials to produce products, but their employees tend to spend more on travel, expenses, and miscellaneous resources such as marketing and office supplies.

?

Left uncontrolled, these discretionary expenses can add up quickly and leave little cash flow left for critical growth initiatives. But conversely, when finance leaders transform how they manage spend – for example, by applying intelligent, automated technologies – they can proactively control costs, optimize cash flow, and provide guidance to line-of-business teams on where to direct spending to maximize growth.

?

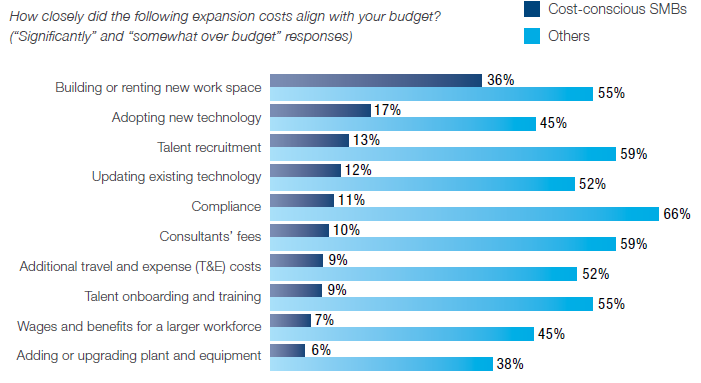

According to a new?study conducted by Oxford Economics, cost-conscious finance leaders achieve the best outcomes – all while keeping expansion costs in line (see Figure 1). Generally speaking, cost-conscious SMBs approach their expansions far differently – and see very different outcomes – than companies that say spending and cash flow were not important factors in their growth decisions.

Figure 1: Cost-conscious SMBs stay in budget, even during expansion.

?

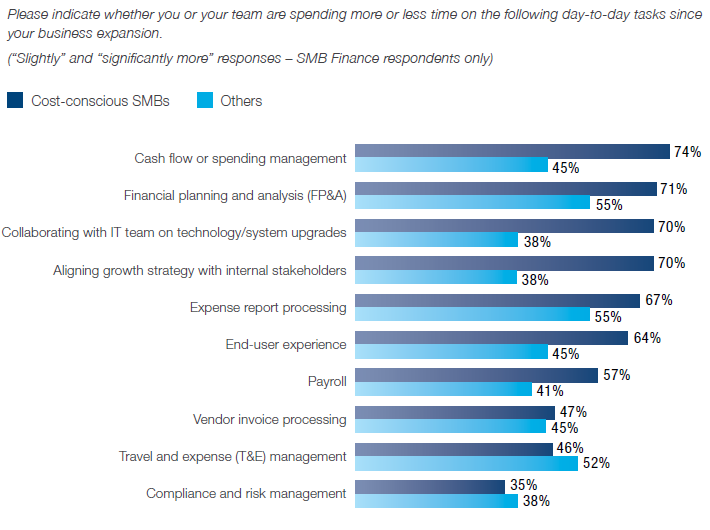

So the big question is, what’s so different about how cost-conscious finance leaders manage spending and costs? This same study reported that?93% of cost-conscious SMB executives agree they have the right platforms and systems in place to adapt to their growing organization, vs 79% of less cost-conscious executives. In other words, they have the right technologies enabling visibility and control over spending, which equips them to prevent spiraling costs, make better decisions, and provide better guidance to lines of business. Their finance departments also work more efficiently, as they report spending less time and effort on core finance tasks relative to their less cost-conscious peers – despite the fact that they are growing and there’s more to do (see Figure 2).

Figure 2: Cost-conscious SMBs that report having the right platforms and systems in place to adapt to their growing organization spend less time and effort on core finance tasks.

?

Clearly, cost-conscious SMBs are on the right track – and you can learn from their success by from Oxford Economics now.